With the high competition in the market, coming up with a fintech app idea can be daunting. You are battling doubts and anxieties: How do you ensure your app stands out? What features are critical for user retention? How can you guarantee a seamless user experience while keeping the data secure?

Contents:

Rest assured, you are not alone. Many aspiring fintech entrepreneurs face these hurdles daily. This article is your comprehensive guide on how to create a fintech app, written to empower you with practical insights, strategic tips, and essential best practices for turning your concept into a market-ready product. Whether you are seeking to simplify payments, enhance budgeting, or revolutionize wealth management, we will walk you through the steps from ideation to launch.

Understanding the Fintech Landscape

Let’s start with the industry landscape and current market trends.

The Americas (North America, South America, Central America, and the Caribbean) are the region with the largest number of fintechs globally. Last year, the global fintech market was estimated at $294.74 billion and is expected to reach $340.10 billion this year. In ten years, the market might reach $1,152.06 billion.

Based on technology, the fintech market is divided into AI, blockchain, RPA, cryptography, biometrics, and other sectors. Last year, the blockchain segment had the largest market share. Still, Artificial Intelligence is thriving, so the connected sector is poised to grow at the highest CAGR.

Fintech Trends

Now, what trends can you leverage to build a fintech app? There are some notable tendencies:

Integration of Artificial Intelligence

It comes as no surprise that AI is transforming financial operations. From chatbots providing customer support to algorithms offering personalized financial advice, machine learning enhances both user experience and operational efficiency. You can harness these technologies to predict people’s spending habits, helping them make informed decisions.

Rise of Decentralized Finance (DeFi)

Decentralized finance is gaining traction as users seek alternatives to traditional banking. Fintech apps offering access to DeFi services, such as lending, borrowing, and trading without intermediaries, are becoming popular. This trend reflects a shift toward transparency and autonomy in financial transactions.

Open Banking and APIs

The adoption of open banking is reshaping how applications interact with users’ financial data. This concept allows third-party developers to build services around financial institutions. By leveraging APIs, you can offer innovative platforms that aggregate data from multiple banks, enabling people to have a holistic view of their finances.

Embedded Finance

The trend of embedded finance continues to grow, where fintech services are integrated into non-financial platforms. Businesses are increasingly offering financial products like payments, loans, and insurance within their existing services, providing convenience for users.

Cryptocurrency Integration

With the growing interest in cryptocurrencies, many fintech apps are now incorporating crypto-related services, such as trading, wallets, and educational resources. Providing users with tools to manage digital assets alongside traditional finances is becoming a unique selling point.

Types of Fintech Apps

The types are as diverse as the financial needs they aim to address. Depending on the target audience and your business goals, you can pick one of the following for your future project:

Payment Processing Solutions

Digital transactions and e-commerce are thriving, and so are payment processing apps. This popular type facilitates transactions between consumers and businesses. The category includes:

- Digital Wallets: Services like PayPal, Apple Pay, and Google Wallet allow users to store payment information and conduct transactions seamlessly.

- Point of Sale (POS) Systems: Modern POS systems go beyond traditional registers, enabling e-commerce businesses to accept various payment methods, manage inventory, and analyze sales data.

- Payment Gateways: These solutions act as intermediaries between businesses and customers, securely processing online payments and ensuring the transaction is smooth and safe.

Personal Finance Management Apps

PFM software assists people in managing their finances more effectively. With features like budgeting tools, expense tracking, and investment recommendations, they can form healthy financial habits. Examples include:

- Budgeting Apps: Applications like Mint and YNAB help users create budgets, track spending, and save money based on their financial goals.

- Investment Trackers: Tools like Personal Capital provide insights into users’ investment portfolios, helping them make informed financial decisions.

- Debt Management Apps: Solutions like Tally and Undebt.it help users pay off debts faster through customized repayment plans and consolidation options.

- Savings Apps: Platforms like Qapital and Digit automate savings by analyzing spending patterns and setting aside optimal amounts.

- Micro-Investing Apps: Services like Acorns and Stash allow users to invest spare change from everyday purchases.

- All-in-One Finance Apps: Comprehensive tools like MoneyLion and Simplifi combine budgeting, investing, and banking features in single platforms.

- Bill Payment Apps: Utilities like Prism and Mint Bill Pay help users track and pay bills on time while avoiding late fees.

- Credit Monitoring Apps: Services like Credit Karma and Experian provide free credit scores and improvement recommendations.

- Subscription Management Apps: Tools like Truebill and Rocket Money help identify and cancel unwanted recurring charges.

- Tax Preparation Apps: Solutions like TurboTax and H&R Block simplify tax filing with guided interviews and deduction finders.

Investment Platforms

Fintech has democratized access to investment opportunities through various stock trading platforms. This category can be divided into:

- Robo-Advisors: Automated investment platforms like Betterment and Wealthfront offer algorithm-driven financial planning services with little to no human intervention, providing low-cost investment management.

- Stock Trading Apps: Platforms like Robinhood and eToro allow users to buy and sell stocks or cryptocurrencies with intuitive interfaces and minimal fees.

- Retirement Planning Platforms: Services like Blooom and Wealthramp specialize in 401(k) and IRA management, offering personalized retirement strategies.

- Social Trading Networks: Platforms like eToro and ZuluTrade enable users to copy trades from experienced investors, creating a community-driven investment approach.

- Fractional Share Apps: Services like Public and Stash allow investors to purchase portions of expensive stocks, making high-value shares more accessible.

- AI-Powered Investing: Platforms like Q.ai and Kavout use artificial intelligence to analyze market trends and suggest optimized portfolios.

- Cryptocurrency Exchanges: Specialized platforms like Coinbase and Binance facilitate the trading of digital currencies and tokens with various security features.

- Alternative Investment Platforms: Services like Yieldstreet and Masterworks provide access to non-traditional investments including real estate, art, and private equity.

- Institutional-Grade Platforms: Professional tools like Interactive Brokers and TD Ameritrade offer advanced charting, research, and trading capabilities for serious investors.

- ESG Investing Platforms: Specialized services like OpenInvest and Earthfolio focus on environmentally and socially responsible investment portfolios.

- Web3 Platforms: Decentralized platforms like Uniswap and Aave enable peer-to-peer trading, lending, and yield farming through blockchain technology, eliminating traditional intermediaries.

Lending Solutions

These fintech apps refer to technology solutions designed to streamline the loan origination and management processes for financial institutions, lenders, and borrowers. They encompass various features that facilitate the entire lending workflow, from application to underwriting, disbursement, and repayment:

- Peer-to-Peer (P2P) Lending Platforms: Services like LendingClub connect borrowers with individual lenders, bypassing traditional banking channels.

- Alternative Credit Scoring: Innovative tools utilize non-traditional data points to assess creditworthiness, enabling lenders to make informed decisions on loan applications.

Blockchain and Cryptocurrency Solutions

The rise of digital currencies and blockchain technology has introduced new apps that leverage decentralization and security. Notable examples include:

- Cryptocurrency Exchanges: Platforms like Coinbase and Binance allow users to buy, sell, and trade various cryptocurrencies.

- Blockchain as a Service (BaaS): Companies like IBM and Microsoft offer BaaS solutions, enabling businesses to build their blockchain applications without developing underlying technology.

Regulatory Technology

As financial regulations become more stringent, RegTech software helps businesses comply efficiently. Key functionalities include:

- Compliance Management: Software tools such as ComplyAdvantage and Riskified assist organizations in adhering to rules and regulations, including anti-money laundering (AML) and Know Your Customer (KYC) requirements.

- Data Security Solutions: Cybersecurity software protects sensitive financial data against breaches and threats, helping companies navigate regulatory challenges.

Insurance Technology

It is designed to optimize and enhance the insurance industry. This includes improvements using technologies such as data analytics, artificial intelligence, machine learning, the Internet of Things (IoT), blockchain, and more:

- Quote Comparison Platforms: Fintech apps that allow users to compare insurance quotes from multiple providers in real-time.

- Claims Automation Tools: Software that streamlines the claims process, enhancing speed and reducing the likelihood of errors.

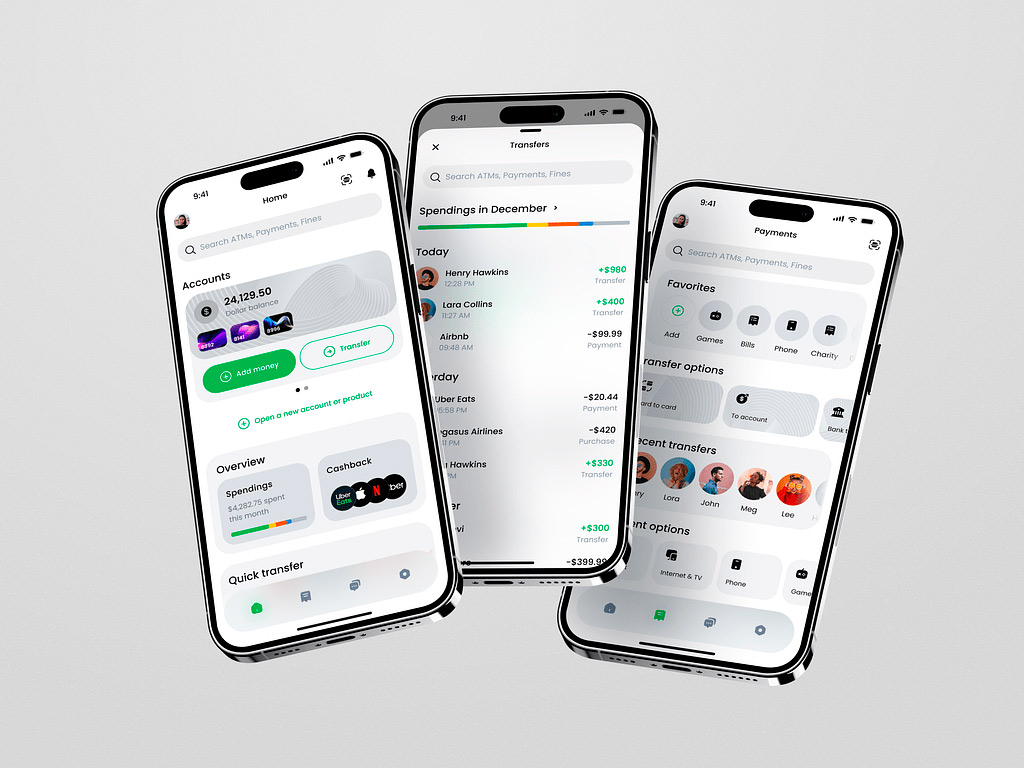

Finance Management Mobile App by Shakuro

Challenges in the Fintech Sector

Fintech app development has its own challenges you have to overcome. Here is a short list of issues you should be aware of:

- Regulatory Hurdles: You will face stringent regulations designed to protect consumers and maintain market integrity. Navigating these can be daunting, requiring a deep understanding of laws that vary by country and region.

- Data Security and Privacy: With increasing digital transactions, safeguarding user data has never been more critical. You need to prioritize security to build trust and avoid breaches that can damage your reputation and lead to legal complications.

- Market Saturation: The fintech space is crowded, with numerous players including banks, startups, and tech giants. Differentiating your fintech app and offering unique value can pose a significant challenge.

- User Experience: An intuitive interface is a must-have while incorporating complex functionalities. Balancing sophistication with simplicity is crucial for user retention.

- Technology Integration: Integrating with existing financial systems can be complex. Ensuring compatibility and seamless interaction is essential for smooth operation.

How to develop a fintech app

Creating a fintech app is an exciting venture filled with possibilities and challenges abound. To solve them, you need to approach the idea generation and validation processes systematically.

By understanding user pain points, exploring niches, and validating concepts through feedback and user testing, you can build a fintech app that addresses real needs and stands out in a competitive market. With the right strategy, your idea could transform the way people interact with their finances, driving both user engagement and business success.

So, where to start?

Picking Must-Have Features and Monetization

Everything starts with an idea. Once you grasp a sense of what app type you want to build, you can add other elements piece by piece. One of the most important questions you need to answer is what your app will offer to users. And who these users will be?

Must-Have Features

Here are some essential features that you need to consider in order to stay with the flow. Can’t go wrong with them.

- Secure Registration and Login

Implement robust security protocols for user authentication. This can include multi-factor authentication (MFA), biometric login (fingerprint or facial recognition), and email or SMS verification to ensure user identity and protect sensitive data.

- Personal Finance Management Tools

If you choose PFM, then incorporate budgeting, expense tracking, income analysis, and financial goal-setting features. Users appreciate insights into their spending habits and automatic categorization of transactions.

- Automated Savings and Round-Up Features

Implement features that help people save automatically by rounding up purchases and saving the spare change or creating recurring deposits to savings accounts.

- Financial Reporting and Insights

Offer detailed reports and visualizations of spending and saving trends. Users appreciate having clear insights into their financial health and progress over time.

- Customization and Personalization Options

Allow people to customize their dashboard, notifications, and features according to their preferences. Personalization enhances user engagement and satisfaction.

- Real-Time Notifications

Push notifications for transactions, bill due dates and spending alerts keep users informed and help them manage their financial activities proactively.

Monetization Strategies

There is no business without revenue, so you also need to plan out how you will monetize your fintech app. It can be challenging, but there are several effective strategies to generate revenue while providing value to users.

- Subscription Model

Users pay a recurring fee (monthly or annually) for access to premium features, tools, or content. This model works well for budgeting tools, investment platforms, or financial advisory services.

- Transaction Fees

Charge people a fee for processing transactions, such as payments, transfers, or trades. It is common in payment processing apps, stock trading platforms, and peer-to-peer lending services.

- Freemium Model

Offer a free version of the app with basic features while charging for advanced features or tools. This approach helps attract a larger user base initially, with the potential for conversion to paid users.

- Affiliate Marketing

Partner with financial institutions or services to earn a commission by referring users to their products, such as credit cards, loans, or investment accounts. People can benefit from personalized offers while the app generates revenue.

- Data Monetization

Leverage aggregated, anonymized user data to derive insights and trends that can be sold to third parties, such as market research firms or financial institutions. However, this approach must prioritize user privacy and comply with regulations.

- Advertising

Incorporate advertising within the app by partnering with relevant brands or services. Targeted ads can generate revenue, especially if the user base is extensive and engaged. However, the ad experience should not compromise user experience.

- Value-Added Services

Offer additional services for a fee, such as financial consultations, customized reports, or premium educational content. This can cater to users looking for tailored guidance in managing their finances.

- In-App Purchases

Allow users to buy specific features or tools individually. This could include financial planning templates, advanced analytics, or personalized financial advice, providing flexibility in payment.

- Interest on Deposits

If you want to build a fintech app that provides banking or savings functionalities, earn interest on users’ deposits by lending them out to other borrowers or through various investment vehicles.

- White-Label Solutions

Offer your app’s technology as a white-label solution to other businesses or financial institutions, allowing them to use it under their brand for a fee.

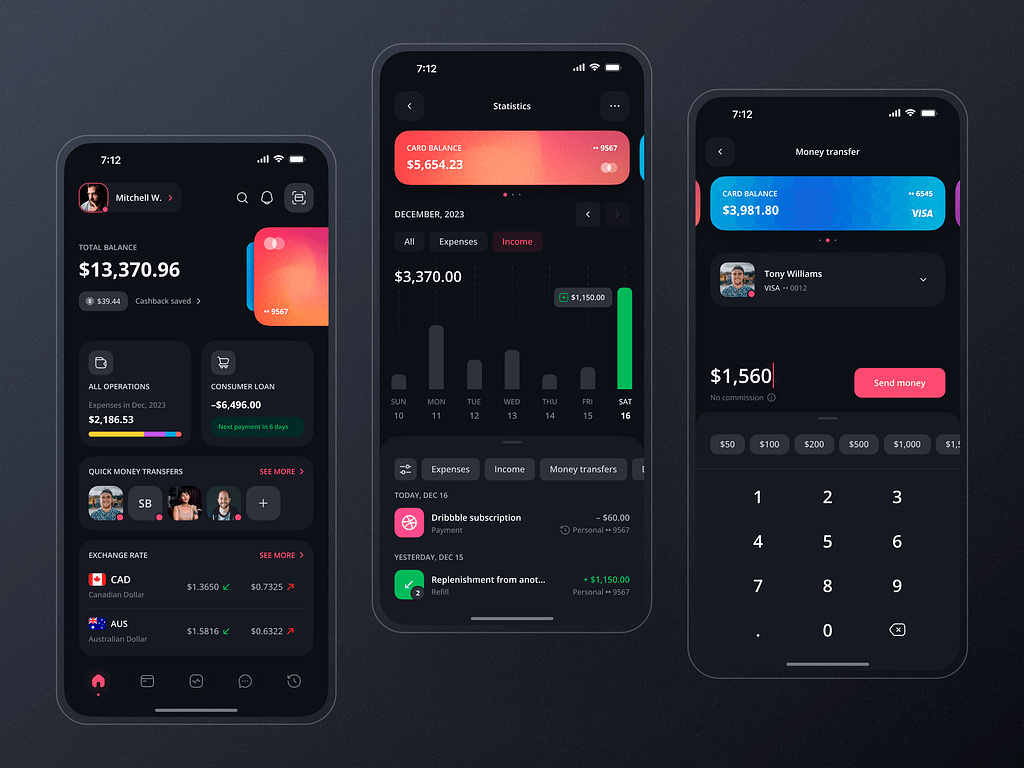

Abyss Crypto Management App by Conceptzilla

Planning Your Fintech App

A well-thought-out business plan is the foundation of any successful app. It serves as a roadmap for your venture and a compelling narrative for potential investors and stakeholders.

- Executive Summary

Begin with a concise overview of your app, highlighting its purpose, target audience, and unique value proposition. This section should encapsulate your vision to capture attention and entice stakeholders.

- Market Research

Conduct thorough research to understand current market trends, identify competitors, and assess your target demographic. Look for gaps in the market that your app can fill and highlight these opportunities within your plan.

- Business Model

Define how your app will generate revenue. We mentioned some common monetization models above. Keep in mind that each has its implications on pricing strategies and user acquisition.

- Regulatory Considerations

Address the essential regulatory requirements that your fintech app must comply with. Detail how you plan to navigate these requirements and any partnerships with legal experts to ensure compliance.

- Marketing Strategy

Create a comprehensive marketing plan that outlines how you will acquire users and retain them. Consider digital marketing techniques, partnerships, influencer marketing, and community engagement as potential strategies.

- Financial Projections

Provide realistic financial projections, including startup costs, revenue forecasts, and break-even analysis. Investors will want to see not just potential profitability but a clear path to achieving it.

- Implementation Timeline

Develop a timeline indicating key milestones, from development phases to marketing launches. This roadmap will help keep your team accountable and on track.

- Team and Management Structure

Outline the team structure, key roles, and responsibilities. Highlight the expertise of team members, especially in technology, finance, and marketing, to instill confidence in your capabilities. We will dwell on the topic of choosing a team for fintech app development a bit later.

Navigating the UI/UX Design Process

Once your business plan is in place, the next step is creating an engaging and intuitive user experience through responsive fintech app design. The process should focus on understanding the target audience’s needs while ensuring aesthetics and functionality. Here’s a structured approach you can follow:

Conducting User Research

First, gather insights about your target audience. Utilize methods like surveys, interviews, and usability testing to understand their behaviors, needs, and pain points.

Creating User Personas

Based on your research data, develop detailed personas that represent segments of your user base. They should include demographics, goals, pains, and preferred financial services. With this information, you can build a fintech app with a design aimed exactly at the users’ hearts.

Making Wireframes

Turn your ideas into low-fidelity wireframes, sketching out your app’s interface’s basic layout and structure. This visual representation helps clarify functionality and navigation without getting lost in details.

Building Prototypes

Move from wireframes to a higher-fidelity prototype that closely mimics the user experience. Prototypes allow for better interface visualization, so you can test various hypotheses, find drawbacks, and add improvements.

Conducting User Testing

Challenge your prototypes during usability tests with real users. Create a test case similar to a real-life problem, then observe how people navigate and where they encounter friction. Their feedback is invaluable for understanding which design elements work and which require refinement.

Forging UI Design

Once the user experience is validated, shift focus to the visual aspects of the app. Develop a style guide that encompasses your color palette, typography, iconography, and overall brand aesthetics. The UI should be visually appealing while remaining consistent.

Crypto Trading Mobile App by Conceptzilla

Fintech App Development: Costs & Process

Successful development involves more than coding and design; it requires strategic decision-making at every stage. From selecting the right technology stack to hiring developers, as well as launching with an MVP, each choice plays a crucial role in your app’s success. Let’s explore these key elements in detail.

Ultimately, the decision should align with your project scale, budget, and long-term vision for the fintech app.

Development Team

What fintech app developers do you need to build your product? It depends on the initial concept and features you opted for, but in general, you need to hire:

- Product manager: Responsible for defining the app’s vision, strategy, and roadmap. They coordinate between teams and manage the project timeline.

- Front-end developer: Responsible for building the client side of the app, ensuring a responsive and interactive user interface using technologies like HTML, CSS, and JavaScript frameworks (React, Angular, etc.).

- Back-end developer: Works on server-side logic, database management, and application programming interfaces (APIs). They use programming languages such as Python, Java, Node.js, or Ruby, and manage database systems like PostgreSQL or MongoDB.

- DevOps engineer: Focuses on the deployment, integration, and scaling of the app. They manage cloud services, automate processes, and ensure continuous integration and delivery.

- Mobile developer: If developing for mobile platforms, you’ll need specialists in mobile app development using Swift (for iOS), Kotlin (for Android), or cross-platform frameworks like Flutter or React Native.

- QA Engineer: Tests the app thoroughly for bugs and issues. They also develop test plans, perform manual and automated testing, and work to improve overall app quality.

- Cybersecurity specialist: Ensures the app complies with security standards, particularly important for fintech applications. They help protect sensitive user data and prevent breaches.

- Compliance officer: A specialist who understands local and international financial regulations (like GDPR, AML, or KYC) and helps you adhere to legal requirements.

How Much Does It Cost?

The development involves various costs which can vary widely based on several factors, including the app’s complexity, features, platform, target audience, and development location.

The payroll for fintech app developers can vary significantly based on their location and expertise. You have a choice between an in-house team, an outsourced agency, or a hybrid model. Each approach has its advantages and disadvantages:

Hiring Developers (Outsourcing)

Pros:

- Access to a global talent pool with specialized skills.

- Cost-efficiency, as you can choose developers based on budget constraints.

- Flexibility in scaling the team based on project needs.

Cons:

- Potential communication barriers if working across different time zones and languages.

- Less control over the development process and immediate adjustments.

The average budget for such a team is $30,000 – $300,000 for the whole app based on the region (e.g., Eastern Europe, Asia, etc., may be cheaper than North America or Western Europe).

Building an In-House Team

Pros:

- Greater control over the development process and more effective communication.

- Team members are completely aligned with the company’s vision and culture.

- Easier to integrate feedback and iterate on the app quickly.

Cons:

- Higher fixed costs, including salaries, benefits, and training.

- Finding the right talent in a nearby area can be challenging and time-consuming.

- Limited scalability; hiring new staff requires time and investment.

In terms of the budget, the team takes around $100,000 – $400,000/year depending on size and location.

Hybrid models that involve a small in-house team supported by outsourced resources can be a strategic compromise.

You also need to keep in mind other budget items like third-party integration, backend infrastructure, maintenance, etc. For a basic fintech app, the development costs can range from approximately $50,000 to $200,000.

Choosing the Right Tech Stack

The technology stack you select for fintech app development is fundamental to performance, scalability, and security. Here’s a breakdown of considerations when choosing the right tech stack:

- Frontend Technologies

Opt for frameworks like React or Vue.js for a responsive and dynamic user interface. These libraries facilitate quick development and allow for seamless interaction, which is crucial for maintaining user engagement.

- Backend Technologies

Choose robust backend frameworks such as Node.js or Django. These options provide the security and scalability necessary for handling sensitive financial data and high-user traffic.

- Database Management

Depending on your app’s needs, you can choose SQL databases (like PostgreSQL or MySQL) for structured data or NoSQL databases (like MongoDB) for flexibility and speed. Consider data integrity and security, which are paramount in financial transactions.

- Cloud Services and Hosting

Leverage cloud platforms such as AWS, Google Cloud, or Microsoft Azure for scalability and reliability. These services offer tools for data storage, analytics, and security to ensure your app can grow without interruption.

- Security Protocols

Given the sensitive nature of financial data, prioritize integrating end-to-end encryption, secure APIs, and compliance with standards such as PCI DSS (Payment Card Industry Data Security Standard). Choose technologies that provide built-in security measures.

- Integration Capabilities

Your fintech app must support various integrations (payment gateways, banking APIs, etc.). Ensure the selected tech stack has compatibility with APIs that facilitate these integrations, optimizing user experience and operational efficiency.

Building a Minimum Viable Product (MVP)

Now that your concept is ready to implement, let’s see how to create a fintech app.

For small and medium businesses, especially on a tight budget, launching with an MVP is a strategic approach in fintech app development. It allows you to test your concepts in the market quickly while minimizing risk.

Here’s how to effectively build an MVP:

- Identify core features: focus on the essential features necessary to solve your users’ most pressing pain points. Prioritize functionalities that set you apart from the competition and deliver immediate value (e.g., secure payment processing, and budget tracking).

- User-centric design: Opt for an easy-to-navigate interface design because you need to simplify complex financial tasks. Also, leverage the insights you got earlier from user research to inform design decisions.

- Iterative development: adopt Agile methodologies to facilitate rapid iterations based on user feedback. You need to deliver the MVP in small, manageable increments, allowing for adjustments and refinements to be made continuously.

- Gather user feedback: once the MVP is in the hands of real users, actively solicit feedback. Utilize surveys, interviews, and analytics to gather data on user behavior. This information is invaluable for shaping future iterations of the app.

- Plan for scale: while the MVP is stripped down, ensure you have a roadmap for scaling the app. As you gather user insights and validate your concept, be prepared to expand features and enhance capabilities to meet market demands.

Crypto App Design Concept by Conceptzilla

Launching Your Fintech App

How to develop a fintech app and catch the attention of the target audience? This can be pure luck and just the-right-moment thing, however, you can still try the following strategies:

Generate Buzz Before Launch

Creating anticipation is key, and the best way to do this is through a strategic marketing plan that utilizes multiple channels:

Social Media Teasers

Start by crafting a series of engaging teasers that gradually reveal what your app does. Use visually appealing graphics and short videos to intrigue your audience. Utilize countdowns, sneak peeks of features, and user testimonials to build excitement. Platforms like Instagram, Twitter, and TikTok are great for short, impactful content that can go viral. Remember to use relevant hashtags to maximize your reach!

Influencer Partnerships

Collaborate with fintech influencers or micro-influencers who align with your product’s values and target audience. They can authentically endorse your app, providing credibility and expanding your reach. Offer them early access to the product or exclusive features that they can review and share with their followers. Consider hosting live sessions where influencers walk through the app’s features to demonstrate its value in real time.

Pre-Launch Landing Pages

Build a pre-launch landing page that captures interest and leads. It should detail the app’s value proposition, benefits, and features while capturing email addresses for future updates. Think about running a referral program or contests to encourage signups. Building an email list will create a valuable communication channel for you and keep potential users engaged until the official launch.

Launching on App Stores

The day has finally come for your fintech app to go live. You need to optimize and submit your app to App Stores.

Here is how you submit your app to the Apple App Store:

- Prepare high-quality app icons (including different sizes) and screenshots to showcase your app on the App Store.

- Go to App Store Connect and log in with your Apple Developer account credentials.

- Create a New App by clicking on My Apps, then on a Plus sign. Add all necessary information.

- Fill in the app description, keywords, support URL, marketing URL, and copyright details. Use relevant keywords in your title and description. Don’t forget to include a compelling call-to-action that encourages downloads. Good keywords and attractive visuals can make a significant difference in visibility and conversions.

- Once all parts are completed and there are no issues, you can submit the app for review. Apple will review your app for compliance with their guidelines, which may take from a few hours to a few days.

Keep in mind, that there is a fee for registering an Apple Developer account. The current cost is $99 per year for individuals and companies. The fee is charged annually, so you will need to renew it each year to keep your account active.

Plan a Launch Event

To create even more buzz, consider hosting a virtual launch event that showcases your app’s features. Use this opportunity to explain how the product works, highlight user benefits, and answer questions. Live sessions on social media are perfect for this. Notify your email list and social media followers about the event to increase attendance.

Leverage Press Releases

Write and distribute a press release announcing your app’s launch through relevant news platforms and fintech blogs. You can generate buzz by targeting niche publications that cover fintech app development.

Mobile Banking App Design by Conceptzilla

Gathering User Feedback Post-Launch

Once your app is live, the work isn’t over. Gathering user feedback is crucial for improving your product and retaining users in the long term:

In-App Feedback Tools

Implement feedback tools within the app to make it easy for users to share their thoughts and suggestions with you. What’s more, consider using pop-up surveys or feedback forms that trigger after certain user actions. Be careful not to overdo them though, as too many pop-ups will disrupt the user experience.

Monitor App Store Reviews

Actively monitor app store reviews and promptly respond to user comments. Address issues quickly and express gratitude for positive feedback. Engaging with people in the app stores shows that you care and builds a community around your brand.

Continuous Improvement

Use the feedback gathered to iterate on your app. Regular updates that address concerns and introduce new features will maintain interest and improve retention. Also, consider conducting customer interviews or focus groups to gather deeper insights into user experiences.

Regulatory Compliance and Security

In the fintech industry, regulatory compliance and security are non-negotiable. With the increasing complexity of financial transactions and the sensitivity of personal data, you have to adhere to regulations if you build a fintech app.

Let’s break down three critical components: PSD2, KYC, and GDPR.

PSD2 (Revised Payment Services Directive)

It is a European Union regulation that aims to create a more integrated and efficient payments market across Europe. Implemented in January 2018, PSD2 enhances consumer protection, promotes competition, and stimulates innovation in the financial services sector.

Key Features:

- Open Banking: PSD2 mandates banks to provide third-party providers (TPPs) with access to customer data, given that the client consents.

- Strong Customer Authentication (SCA): The directive requires strong authentication for online payments, which involves multiple factors—something the user knows (password), something the user has (mobile device), or something the user is (biometric data).

- Consumer Protection: PSD2 strengthens protection against fraud and unauthorized transactions, ensuring users feel secure while managing their financials.

KYC (Know Your Customer)

This is a set of procedures and regulations that require financial institutions to verify the identity of their clients. KYC is essential in combating fraud, money laundering, and financing of terrorism.

Key Features:

- Customer Identification: Financial institutions gather information to confirm a client’s identity. This can include government-issued identification, proof of address, and other personal data.

- Risk Assessment: KYC procedures involve assessing the risk associated with particular customers. Higher-risk clients might require more stringent verification processes.

- Ongoing Monitoring: KYC is not a one-time process. Fintech companies must continuously monitor transactions and customer behavior to detect suspicious activities and comply with regulatory standards.

GDPR (General Data Protection Regulation)

This one is a comprehensive data protection law enacted by the European Union in May 2018. It governs how organizations collect, store, process, and use personal data.

Key Features:

- Data Protection by Design and by Default: Organizations must incorporate data protection measures from the start of any project and ensure that only necessary data is processed.

- Consent: Explicit user consent is necessary for the collection and processing of personal data. Users must have clear options to accept or refuse data processing.

- User Rights: GDPR grants users several rights, including the right to access their data, the right to erasure (the “right to be forgotten”), and the right to data portability.

- Data Breach Notification: In the event of a data breach, organizations must notify authorities and affected users within 72 hours if the breach poses a risk to consumers’ rights and freedoms.

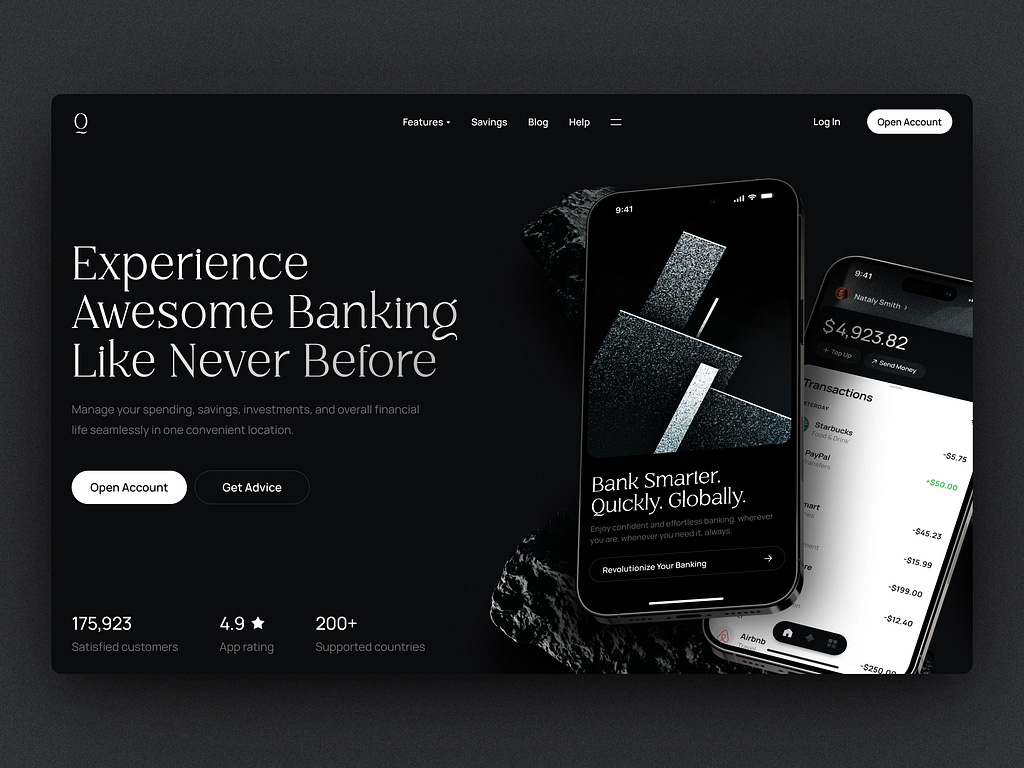

Fintech Website UI Design by Shakuro

Summing up

Now you have a basic understanding of how to create a fintech app. The process requires a thoughtful blend of innovation, user-centric design, regulatory awareness, and robust security measures. You have to make lots of preparations and planning, stay with the flow, and adapt to challenges.

Remember, the journey doesn’t end with the launch, and you need to continuously improve your product. Listen to the users, make compromises, and eventually you will find yourself ahead of the competitors.

Do you need an experienced team to build a fintech app? Contact us and let’s work together on your next project.