To be financially secure, you have to not only keep track of how much you earn but how much you spend. Unaccounted small expenses may seem insignificant, and only seem to exist when you are looking straight at them. Yet, they have the tendency to pile up and fester into bigger problems. Solution? Get your money in order. Still, it’s harder than it sounds. Managing personal finances can be overwhelming. To address this problem, you can offer money management apps to simplify things and win hearts of potential clients.

Contents:

Why even consider diving into this sphere? From 2022 to 2030, the worldwide personal finance app market is estimated to develop at a CAGR of 16.5%. That’s impressive, what about the target platforms? Well, here, the Android app development category leads the industry with a market share of more than 60%. It’s more affordable, flexible, and widespread.

Now, how can you start developing a financial app?

Psychology of the budgeting process

One of the most important steps in creating an app for budget management is understanding the problems of the future user. All people, regardless of social status, subconsciously manage their money flow according to the same psychological model. There are two types of people: spenders and savers. Users from these groups will use the app in completely different ways, and they are looking for particular features of money management.

So, a budget app must meet the requirements of both groups. For spenders, you must offer schemes for reducing costs and budget-conscious spending. And for people who want to save money, an app should offer simple ways to accumulate wealth. A long, difficult pandemic time has affected how people distribute their budgets. Grueling lockdowns deprived us of any possibility to shop outside. In a situation when people had no opportunity to travel, to go to restaurants, or to any other public places to spend money for relaxation.

And this is another psychological moment you should consider while creating your budget app. It’s the rush of compulsive spending after a long inability to do this during the pandemic. Therefore, now the creation of an app for accounting and cost management is very important in helping users spend money wisely and not be left with an empty wallet. During the last two years of the epidemic, Americans spent $1.7 trillion online. So now we can say that people need a good, faithful assistant for budget management to get back on track with their spending.

Moreover, almost 98% of Millennials and 89% of consumers use mobile banking apps daily and plan their budgets with gadgets. Such apps are present on people’s phones, the market growth is promising, and you can have your share now while it’s still easier.

What are financial apps and why people use them

Personal finance apps (also called budgeting or money management apps) are mobile applications that sync your credit cards, bank, and investment accounts under one roof, keep track of all your expenses and visualize them in convenient graphs and charts.

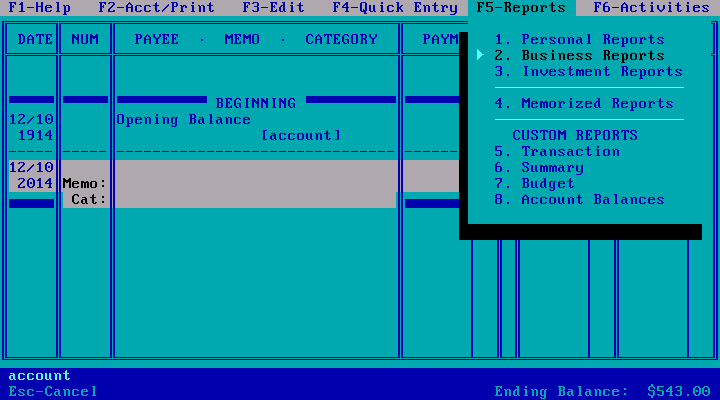

The very first financial apps and services replaced the good old notebooks allowing people to keep records not on paper, but on a computer. The history of personal finance management started in 1983 with the founding of the Intuit company and its flagship product… You guessed it, Quicken, was originally written for MS-DOS and the Apple II.

One of the first versions of Quicken

But as electronic accounting services had more opportunities, they soon began to expand their functionality. Categories of expenses and incomes emerged, along with payment reminders, analytical tools, budget planning, and the ability to have joint accounts with other users.

There are two main types of personal finance apps:

- Manual, where you have to input all the records personally and indicate the figures and category of each purchase or income

- and Linked, where an app draws all the information about your expenses automatically.

There are several reasons why millions of people have a budgeting app on their phones:

- They simplify finance management

- It’s a great way to take control and see exactly what you spend your money on

- They help to save and plan for the future

- They help to prepare for financial emergencies and get out of the credit holes

- They make tax duties less complicated.

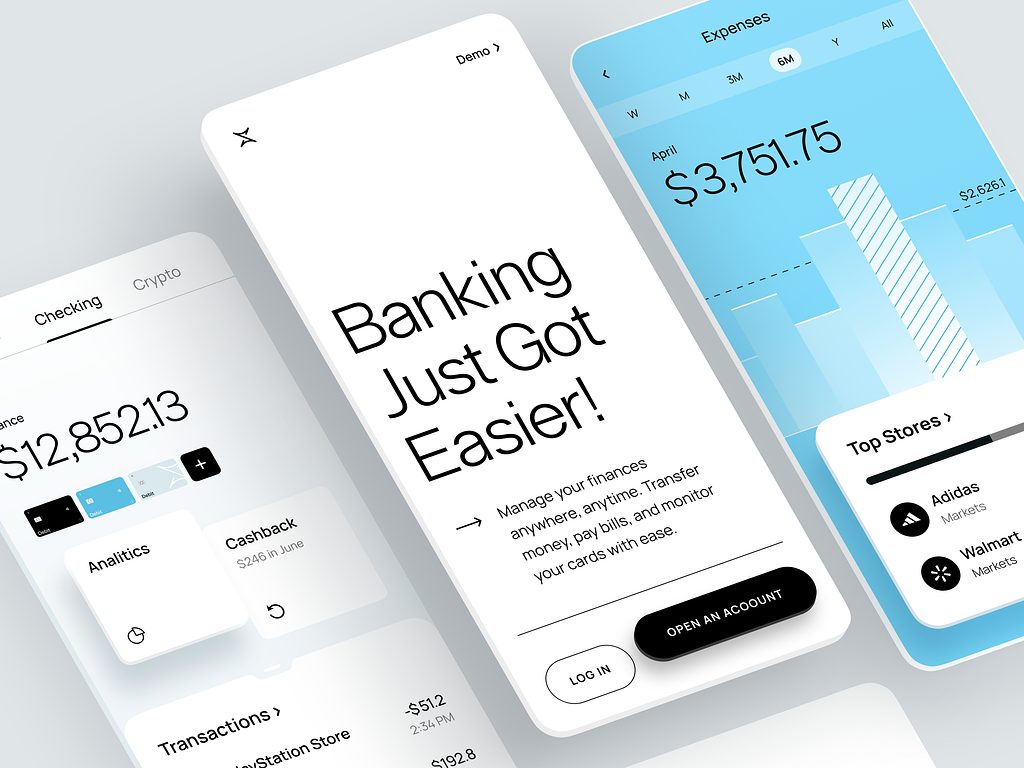

Mobile Banking Application Design by Shakuro

Top personal finance apps for iPhone and Android

Before building your own app, you might want to test several popular personal budget apps to find out why people like them and how you can make something different to gain your competitive advantage. Of course, since every person has a different style of money management and different financial goals, there’s no single opinion on which budgeting app is the “best”. But there are a few apps that are the most popular among users.

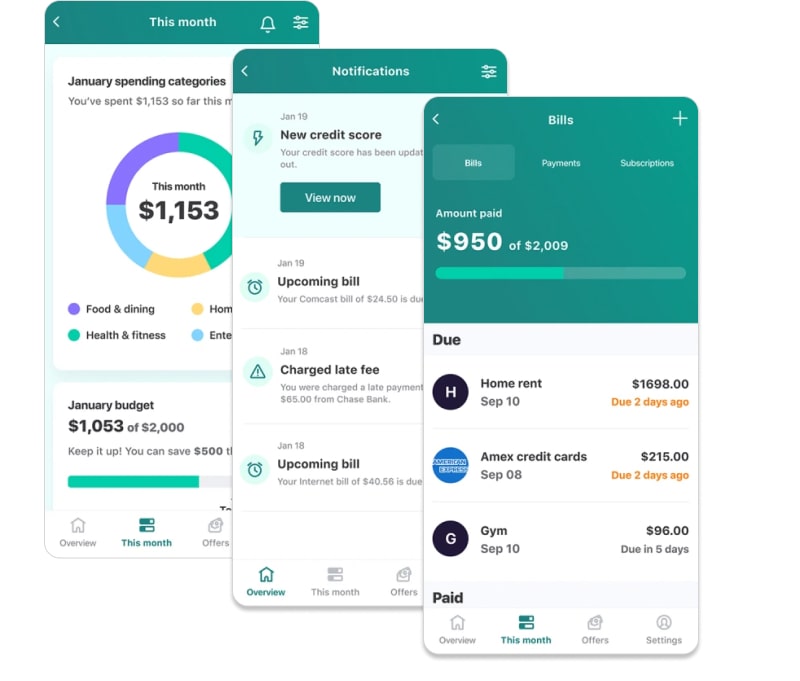

Mint

Pricing: free with in-app purchases.

Mint is the most well-known mobile application for managing personal finances. Users like it because of its simple intuitive interface and customizable tools like bill reminders, and the ability to save for multiple goals. It’s user-friendly and helpful if you want to better understand the general state of your finances:

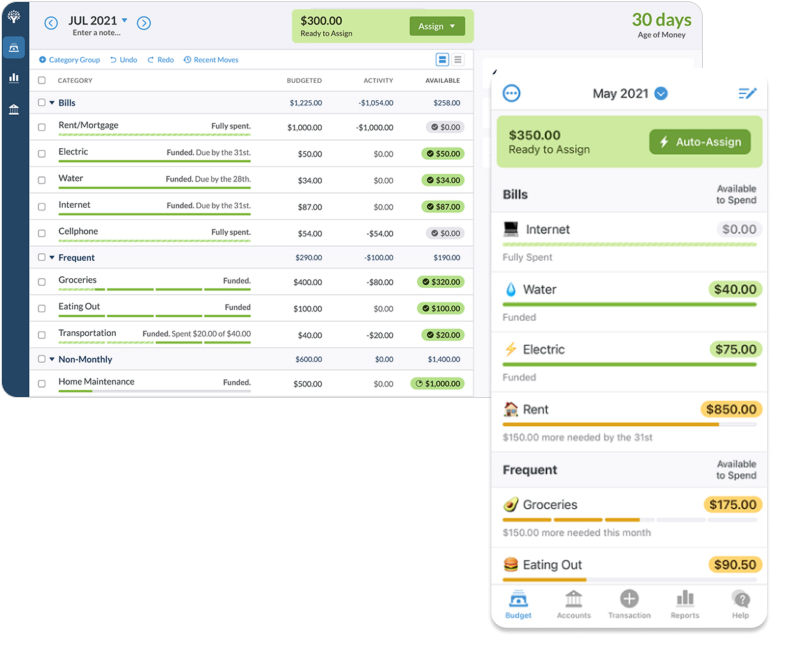

You Need a Budget (YNAB)

Pricing: free for 34 days. Then $14.99 per month or $99 per year.

This app is somewhat more sophisticated than Mint, taking longer to set up, and having an elaborate interface. What’s good about YNAB is that apart from the usually expected budgeting tools and spending monitoring, it also serves as an educational tool, providing instructional videos on how to avoid debt or cut costs:

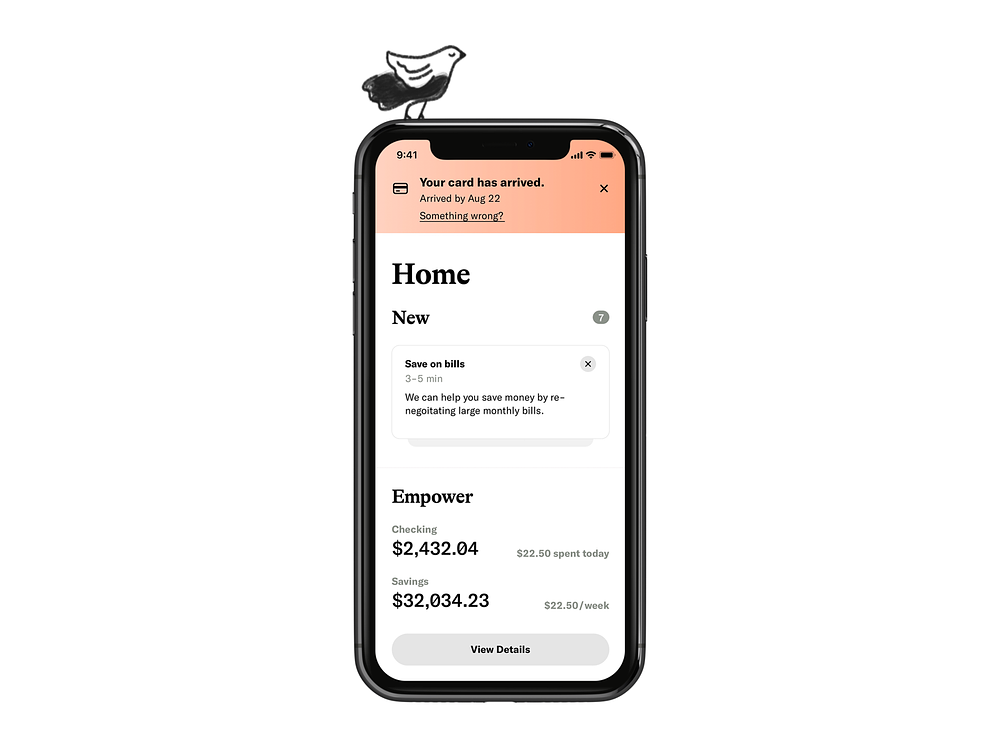

Empower (formerly Personal Capital)

Pricing: free.

Empower uses interactive cash flow tools to help you control spending habits, ensuring that you always stay within limits. But unlike the majority of its counterparts, it’s more of an investment tool. Investment functions consist of interactive advisors giving directions on where better entrust your money and how to review and track your investments:

Empower Home Feed by Sam Elliott

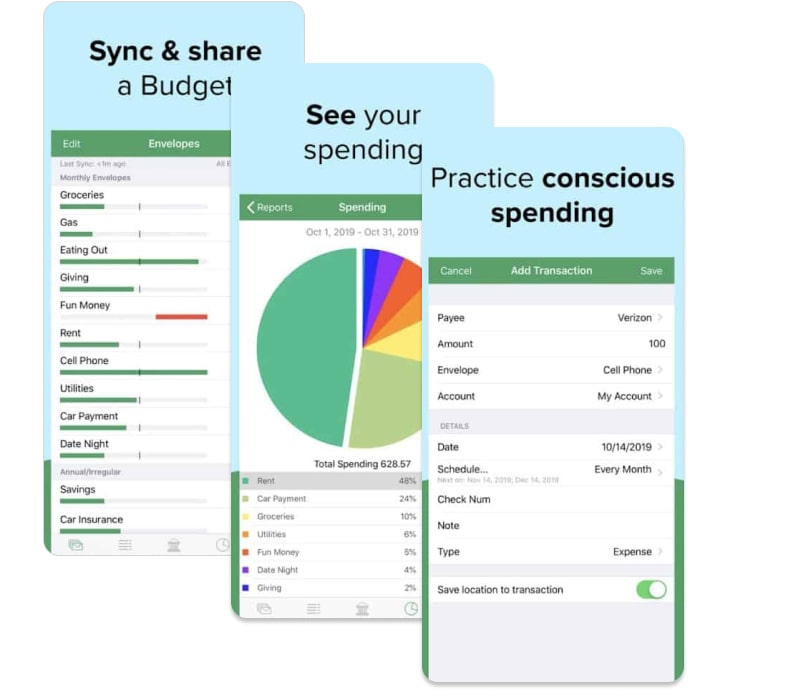

Goodbudget

Pricing: Free. Possible upgrade to $50 a year.

Goodbudget is different from the above apps in a way that it isn’t linked, so all the information has to be input manually. It works on the tested “envelope” principle, taking your income, dividing it into parts, and allocating it into different envelopes for different categories:

Features: What people expect from personal finance apps

Features are what primarily affect the cost of an app. The majority of people expect the following features from a personal finance app:

- Versatile hierarchy of categories, regular payments

- The ability to easily view balances in different bank accounts, and overall financial status

- Integration with banks, receipt scanning

- Standard reports by categories and expenses dynamics

- Regular payment reminders and notifications

- Backup: Google Drive or Dropbox

- Expense tracking with real-time updates

- Goal-setting and progress-tracking

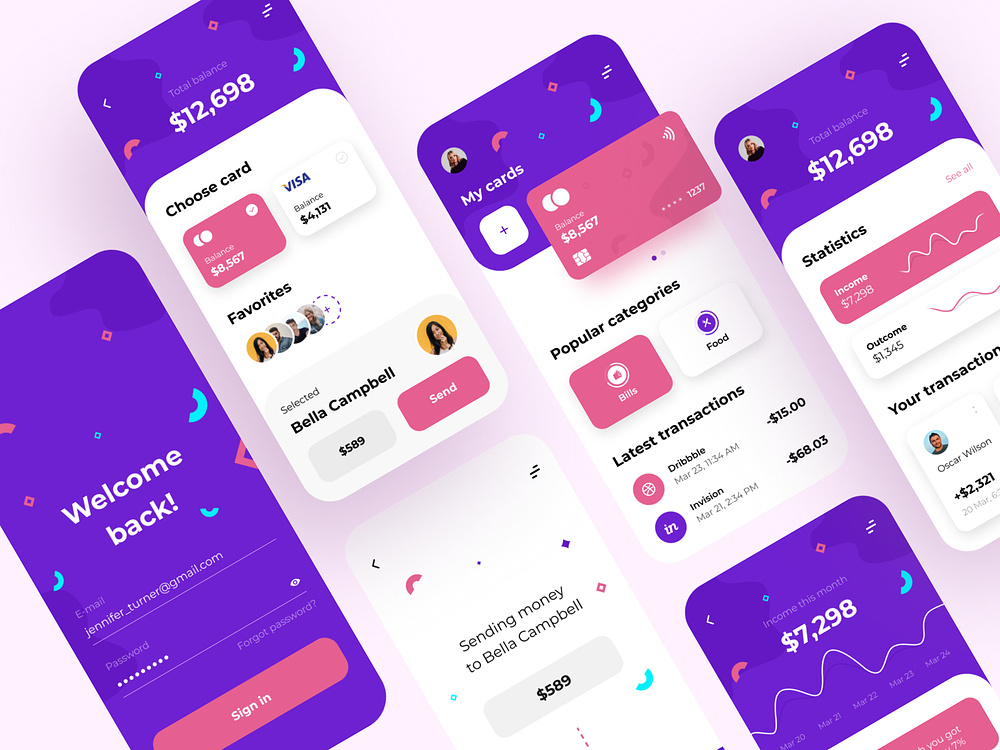

Finance Management Mobile App by Conceptzilla

The main function of budgeting apps is to provide users with transparency over their income and payments and help them have control over their savings goals. Some aspects need special attention:

- Security — the critical aspect of financial apps. “Is my app safe?” is perhaps the biggest concern for potential users. Especially now in the era of personal information leaks and Facebook and Google business models that many people regard as an infringement of human rights. When building a personal finance app, it’s important to pay attention to PCI DSS (Payment Card Industry Data Security Standard) and GDPR (General Data Protection Regulation).

- Personalization — personal money management apps are simpler and more user-friendly compared to business accounting software, but they still need to have some level of flexibility. For example, many users might want a joint finance app for couples or an app to teach their children financial literacy.

- Analytics — for the majority of users, it’s the key feature of personal finance apps. The most important thing for them is to always have a clear picture of how much money they have, where it is, and what it is spent on.

But to be competitive, the aim of every application is to offer something unique. These features are less frequent and may serve as an example of how to differ from the rival apps:

- Investment insights and guidance.

- Money management tips like in YNAB.

- Analytics of forecasted future expenses.

- Payments.

- Product/service comparisons.

Budgeting app design

How will your budget management app look? The main difficulty in the design is finding the golden mean between information content, simplicity, and clarity. Remove unnecessary elements from the screen, leaving only the most useful. Let’s outline some popular trends.

Intuitive and minimalistic approach

Based on hundreds of reviews, it’s clear that what users value most in personal finance apps in terms of design is their simplicity and intuitiveness with a minimalistic approach. Perhaps this can be explained by the complexity of the subject. When people see the previews of simple interfaces, they are more likely to put their trust in those developers who made something clear out of something complex. The task of UX designers is to figure out who their users are and their habits.

Simplicity and clarity of every action

People use personal finance apps on the go, right in a supermarket or a coffee shop, and that’s why they must work fast and be as simple as possible. Add intuitive registration with onboarding to get users acquainted with the product. Tell them how your solution differs from similar apps. Think of ways to minimize the complexities of the financial verification process.

Animations to explain and energize

Many designers place value on the use of smooth micro-animations in such apps. Micro-animations are small functional animations that help users by giving visual responses to actions and showing changes. They are used for various clickable elements like buttons, sliders, or icons. Micro animations help clarify what your current status is and what to expect next.

Financial Assistant App Animation by Shakuro

Technology stack

There are two approaches in mobile app development: native development and cross-platform technologies.

Native development is about using the original programming languages, in particular, Swift (before, it was Objective-C for iOS) and Java or Kotlin (for Android). There are a lot of cross-platform technologies, like React Native, that evolve and become more versatile. However, complex applications are predominantly written using native technologies. Cross-platform problems can include some functions simply not being feasible, the device’s RAM is heavily loaded, the battery quickly running out, etc.

These are the technologies that we use for making mobile apps:

- iOS mobile app: Swift, Objective-C

- Backend/API: Ruby, .NET, Postgre DB

- Admin panel: React, Angular, jQuery

In the case of financial apps, they also cannot manage without APIs (advanced programming interfaces), that is, financial data APIs, that make it possible for separate programs to interact with each other. With their help, fintech software can connect to bank systems and access the data they need to function. So that users of personal budgeting apps could view their accounts directly on the app, rather than switching between an app and a bank’s website.

Personal finance app development cost and time

The potential costs depend on various factors. First, decide on who you are going to work with. You’ll need a team consisting of the following professionals:

- A project manager

- A designer

- Two mobile app developers (depending on the required development speed)

- Two back-end developers (depending on the required development speed)

- A QA engineer

Finance management app development costs

You have three main options, each having its benefits and drawbacks:

- Hiring freelancers is the cheapest option, starting from $10/hour but without any quality guarantee and it’s less secure.

- The in-house development team has the benefit of face-to-face communication and the lower risk of losing data confidentiality, but it’s also the most costly option, ranging from $80/hour up to $150/hour.

- The outsourced team combines the benefits of an in-house team while having one more advantage: finding talent from anywhere in the world, you have a much wider choice of best mobile app developers in comparison to in-house capabilities. The rate differs on where the team is situated: in Eastern Europe, Asia, Latin America, or Africa.

You can turn to the services of freelancers or a professional company. It all depends on your ambitions and budget. We advise you to contact professional app development companies where the entire team — project managers, developers, designers, and QA engineers — are working under one roof. You don’t have to look for each specialist separately and spend time acquainting them with the project.

If you take examples like Mint or YNAB, the whole process of creating such applications takes at least around 2000-2500 hours. Let’s take this approximate calculation, taking the Eastern Europe outsourced rates:

- UI/UX Design: 375 hours x $50 = $18 750.

- Application development (iOS): 780 hours x $35 = $27 300.

- Server-side app development: 920 hours x $35 = $32 200.

- Client-side app development: 270 hours x $35 =$9 450.

Total cost: about $87 700.

How finance apps make money

There are several possible ways to monetize a money management app. You can either make it a paid one and ask your users to pay a monthly or a yearly subscription, or you can choose one of the options used in monetizing free apps.

The best bet for a budgeting app is the freemium model. It allows trying out a product before making a purchase. So a user can download your app with the basic features available, decide whether they like it or not, and pay for additional opportunities. For example, the Money Lover app offers some basic benefits like entering expenses, viewing, and spending habits for free. With a premium subscription, you get extra features, like receipt scanning and automated expense tracking.

Personal Finance – Mobile App by Anastasia Golovko

Trends in personal finance app development

There are more than 8.93 million apps worldwide in Google Play and App Store today, so it’s vitally important to gain an extra competitive advantage. What you can capitalize on:

- It’s a good idea to provide voice commands in your personal accounting app, as most people find it more convenient and fast to voice their expenses instead of typing them.

- Artificial intelligence algorithms are not just a nice marketing gimmick, they can help you use the benefits of technological progress to your advantage. AI analyzes spending habits and offers tips on how to improve them.

- Adding some gamification features to your app is a nice idea that can help users better relate to your app by making it less intricate and more engaging, giving them some sense of achievement.

- A great idea that can increase the popularity of your app would be to add expenses directly to the first screen. You need to simplify the user’s path in the application as much as possible and give them the opportunity to do their intended action immediately upon opening an app. Look at how the Monefy app does it with micro illustrations for every type of expense:

- Also, one of the strongest motivations to use a money management application is the desire for a specific and understandable concept for budgeting. Your task is to come up with a new concept or find the existing one that will help your users to really achieve the accumulation of funds or reduce expenses. If you hope to attract users and keep them, you will definitely need to give them a scheme for all users to clearly understand what they must do, and how to do it, in order to become successful savers.

How about making your own app?

Creating a personal finance app might be a very smart move today, thanks to the booming popularity of the fintech industry. According to UBS, revenues from fintech are expected to increase from $150 billion in 2018 to $500 billion by 2030. It’s going to become one of the world’s fastest-growing sectors, internationally.

People who use budgeting mobile apps often complain about their inconvenience, even the paid ones. Strange statistics, incomprehensible interface, a small number of categories, etc. make you switch from one application to another. When the market is far from being over-saturated it means that there are plenty of chances to contribute with something new. Study your competitors, find out what they lack, and try to imagine what could make your app unique. Maybe adding some cultural aspects? Making it about pets? To compete you need to introduce an app that is custom-made. We can make it for you.

We at Shakuro have experience in developing for the financial industry and know how to deal with the most frequent issues. So, if you are thinking of creating a personal finance app that would turn people’s lives for the better, drop us a line, and we’ll help you make your project complete.

* * *

This article about finance app development was originally published in June 2020 and was updated in August 2023 to make it more relevant and comprehensive.