The Middle East and Near East fintech landscape is transforming rapidly, driven by digital innovation, regulatory reforms, and a tech-savvy population. Countries like Saudi Arabia, the UAE, Egypt, and Kuwait are emerging as fintech hubs, focusing on conventional and Islamic finance. With initiatives like Saudi Vision 2030 and the UAE’s National Innovation Strategy, there is a strong push towards economic diversification and cashless economies, making fintech investment apps increasingly prominent.

Contents:

As a design agency experienced in fintech app development for these regions, we’ve developed strategies to meet users’ unique needs while adhering to Islamic financial principles, local regulations, and cultural preferences. In this article, we’ll guide you through the key considerations and challenges in designing Shariah-compliant fintech apps, drawing from our experience to offer insights into successful solutions.

Tips for Fintech App Development for Middle & Near East

Shariah Compliance: A Foundation for Trust

Islamic finance principles are at the core of fintech apps targeting Muslim users in the Middle East. Shariah compliance is essential to earning users’ trust, as Islamic law prohibits financial practices like riba (interest), gharar (excessive uncertainty), and investments in industries deemed haram (e.g., alcohol, gambling). Offering halal financial instruments that adhere to these rules is key to attracting users.

Sukuk is a vital product in Shariah-compliant finance, an alternative to conventional bonds. Sukuk must represent ownership in tangible assets and follow profit-sharing models rather than generating interest. To meet user expectations, you must ensure these products are certified by a Shariah advisory board, enhancing the client’s confidence in the platform.

Key considerations:

- Avoid interest-based financial products.

- Ensure transparency in investment risks.

- Offer products certified by a Shariah advisory board.

Our solution:

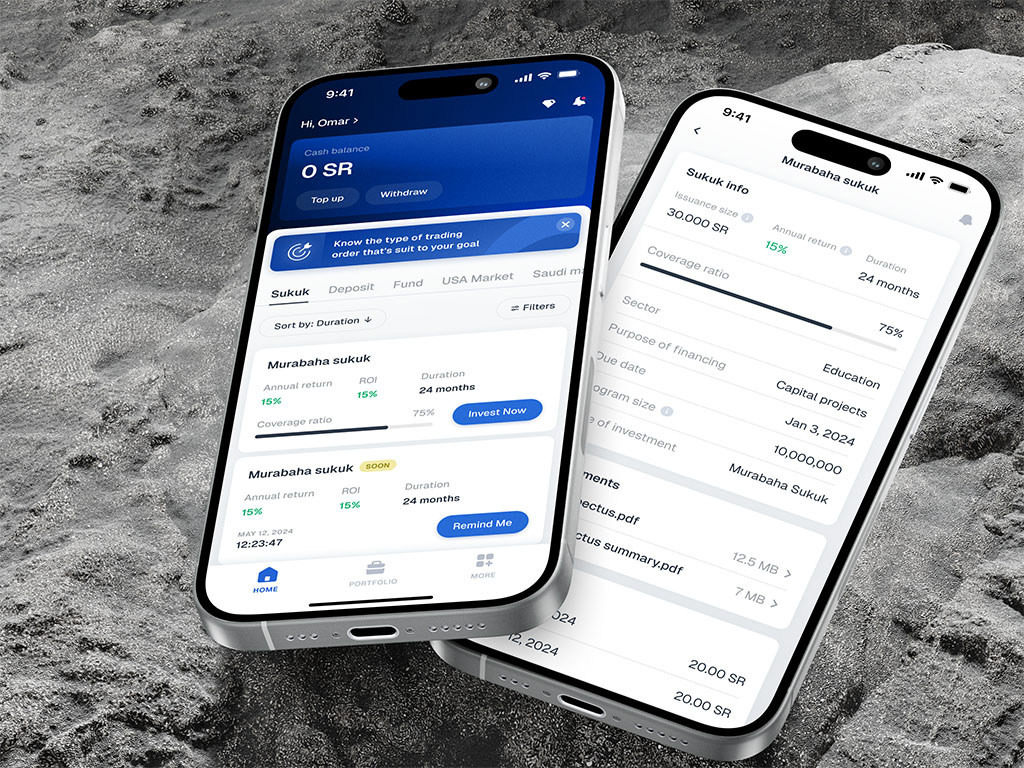

For the Dinar Investment app, we focused on integrating a full range of Shariah-compliant investments, including Sukuk. We worked closely with our clients to ensure all financial instruments met Islamic finance standards, building user trust through transparency and adherence to Islamic principles.

During fintech app development, we conducted an in-depth analysis of Sukuk to understand the unique features of this Shariah-compliant financial instrument and design an optimal user experience. Unlike conventional bonds, Sukuk represents ownership in tangible assets and operates on a profit-sharing model rather than interest, which is prohibited under Islamic law. Given its distinct structure, it was crucial to determine the most relevant information to display and the order of priority for that information.

Our research focused on identifying the key details that users value most, such as asset backing, profit distribution schedules, and Shariah compliance certifications. We structured the Sukuk page to highlight these aspects clearly, ensuring that users can quickly access critical information and understand the benefits of investing in Sukuk. By doing so, we created a well-organized and intuitive interface that aligns with Islamic financial principles while enhancing the user experience.

Dinar Investment app

Cultural and Linguistic Localization: Designing for Local Preferences

Localization involves more than translating an app into Arabic; it requires aligning the design with the local population’s cultural, religious, and financial needs. The user interface must be intuitive, not just in language, but in its layout and user experience to feel familiar.

Cultural sensitivities around money and investment also vary, so when you build a fintech app, you need to integrate educational content on investment in Arabic to help users feel more comfortable. Additionally, the visual design should reflect traditional preferences — being clear, elegant, and respectful.

Key considerations:

- Add the Arabic language, including regional dialects.

- Create intuitive interfaces that resonate with Arab users.

- Provide culturally appropriate financial literacy content.

Our experience:

With Dinar, we faced a unique challenge. Unlike typical projects where we start with English designs and adapt them to Arabic, the client provided initial designs in an Arabic layout. Our task was to carefully translate and adapt these designs into English. This required more than just a direct language translation—it involved rethinking the layout and user experience to suit the left-to-right reading format while maintaining the integrity of the original fintech app design.

We had to ensure that the navigational flow, visual hierarchy, and cultural nuances of the Arabic version were preserved in the English version, so both sets of users could enjoy a seamless experience. We maintained consistency in branding, usability, and functionality across both versions while making sure the adaptation was culturally appropriate for English-speaking users.

Another case is Bless You, where we completely adapted the app for Arabic-speaking countries, including cultural differences, law regulations, special fonts, careful placement of the elements, and RTL reading.

Arabic version for Bless You

Regulatory Compliance and Data Security

Every country in the Middle East and the Near East has its regulatory standards for fintech apps, and adhering to these is essential for credibility and legal compliance. Countries like Saudi Arabia have strict guidelines enforced by the Capital Market Authority (CMA) and Saudi Central Bank (SAMA), particularly around data privacy and cybersecurity.

Building trust also means ensuring data encryption and multi-factor authentication to protect user information. By following local cybersecurity frameworks, you can enhance the product’s credibility and gain user confidence.

Key considerations:

- Comply with regional financial regulations and data privacy laws.

- Implement strong cybersecurity measures and encryption.

- Utilize multi-factor authentication for enhanced security.

Our solution:

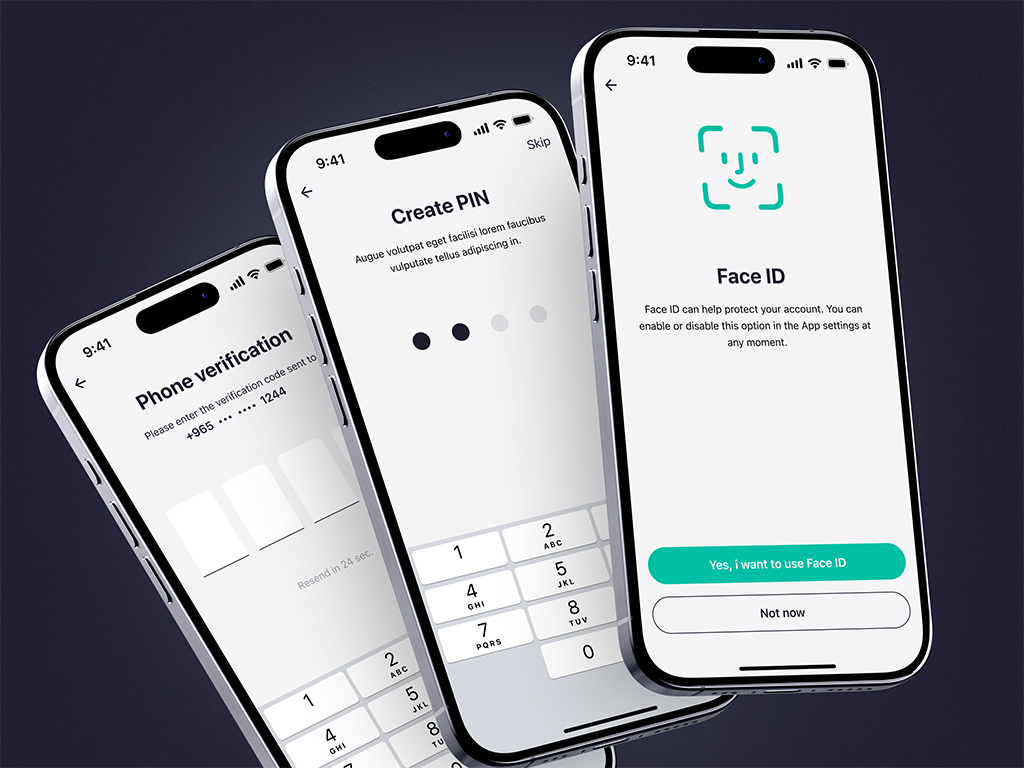

For ZAD, we designed a multi-step login process to give users extra protection and to ensure compliance with Saudi regulatory frameworks. In addition to verifying their phone number, users are asked to create a password and a PIN code for added security. We also included the option to log in using Face ID, making it more convenient while keeping their account safe. These measures protected sensitive data and built a strong foundation of trust with users.

ZAD app

Zakat: Integrating Religious Obligations into Fintech Apps

A unique challenge in developing Shariah-compliant fintech apps is the Zakat integration—the obligatory charitable donation in Islam. The app must calculate the Zakat amount based on a user’s financial holdings, considering the Nisab threshold, and offer easy payment options to approved charities.

Integrating features like Zakat reminders and seamless payment options enhances the user experience while aligning the platform with Islamic religious values.

Key considerations:

- Automate Zakat calculation across various financial instruments.

- Provide seamless payment options for Zakat contributions.

- Include reminders for upcoming Zakat deadlines.

Our solution:

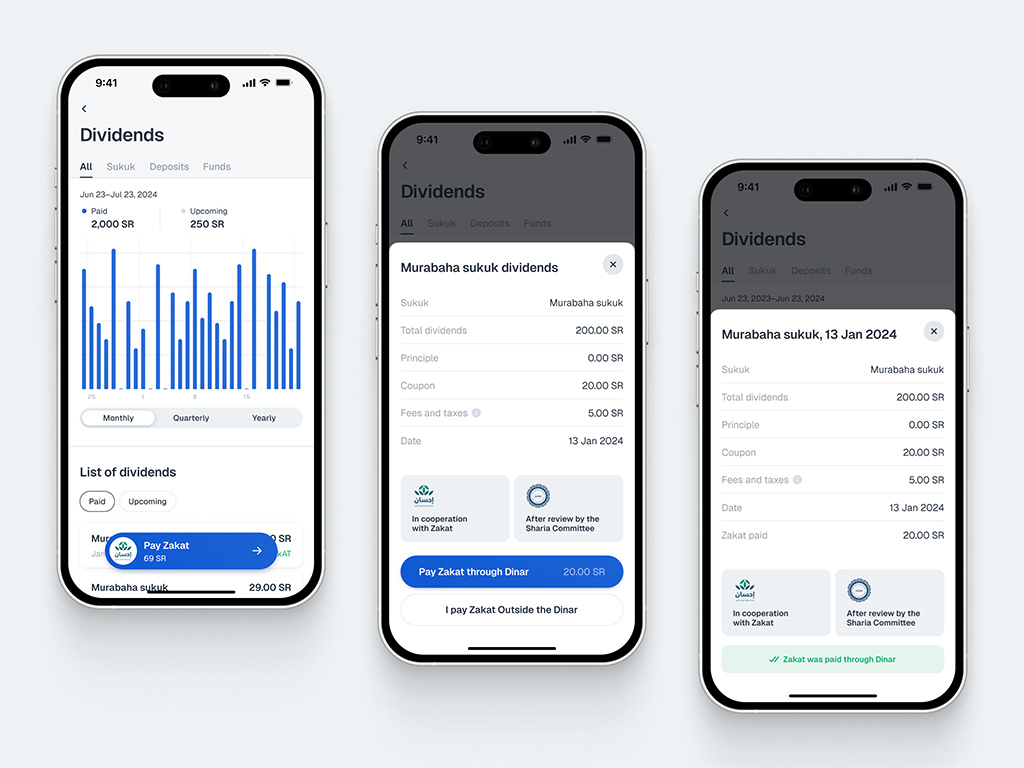

For Dinar Investment, we integrated the Zakat component within the Dividends section, making it easily accessible and visible in the fintech app design. We added a sticky CTA button at the bottom of the page, ensuring that users can find it quickly to pay the Zakat they owe at any moment. This feature helps users fulfill their religious obligations easily.

In collaboration with our clients, we developed two convenient options for paying Zakat: directly within the Dinar Investment app or through a third-party service. In both cases, the app tracks the status of the Zakat payment, allowing users to check their payment completion.

Zakat in Dinar app

Color Choice in Shariah-Compliant Apps

During fintech app design and development, you should pay attention to color choices to align them with Islamic values, cultural norms, and user expectations. For example:

- Green is a highly favored color due to its significance in Islam, symbolizing growth, prosperity, and paradise. It is often used in financial and investment apps to highlight ethical growth and compliance with Islamic law.

- Blue is another common choice, representing trust, stability, and professionalism.

These colors help you create a sense of security and reliability, which is crucial for fintech and healthcare platforms in the Middle East.

At the same time, use certain colors with caution.

- Red, for example, is typically reserved for error messages or warnings due to its association with danger or negative financial implications.

- Neon and overly bright colors are generally avoided, as they can come across as flashy and are inconsistent with the Islamic principles of modesty and moderation.

- Additionally, gender-specific colors, like pink, should be minimized to ensure inclusivity and appeal to a broad audience.

By selecting colors that align with these cultural and religious sensitivities, you can create a trustworthy, user-friendly experience while adhering to Islamic principles.

Our solution:

In our work with the ZAD app, we chose green as the leading color to reflect the app’s focus on ethical growth and Shariah-compliant investments, resonating with users’ values.

Colors in ZAD app

For Dinar Investment, we used blue tones to highlight the platform’s reliability and long-term stability, creating a calm and professional atmosphere suited to investment management. Both color choices were made with cultural significance and user trust in mind.

Blue colors in Dinar app

Illustrations in Arabic Fintech Apps: Tradition Meets Innovation

Designing illustrations for Shariah-compliant Arabic investment apps requires a delicate balance between tradition, cultural respect, and modern design innovation. Abstract fintech app design and religious symbols often replace lifelike depictions, respecting Islamic artistic principles while maintaining a modern and engaging user interface.

Key considerations:

- Use minimalistic or abstract human figures to respect Islamic guidelines.

- Employ religious symbols in a respectful, subtle manner.

- Combine traditional and modern design elements for a balanced approach.

Our solution:

- ZAD: Relatable, Modern Male Character

For ZAD, an investment app for a Bahrain-based company, our task was to create a friendly and approachable character without violating Islamic guidelines on depicting human figures. We designed a male character in modern, modest clothing — like jeans and a jersey — who reflects the typical Middle Eastern man. Although his facial features were minimal, we added subtle expressions to keep the character engaging. This allowed us to connect with users while respecting Islamic artistic traditions and cultural expectations around modesty.

Illustrations in ZAD app

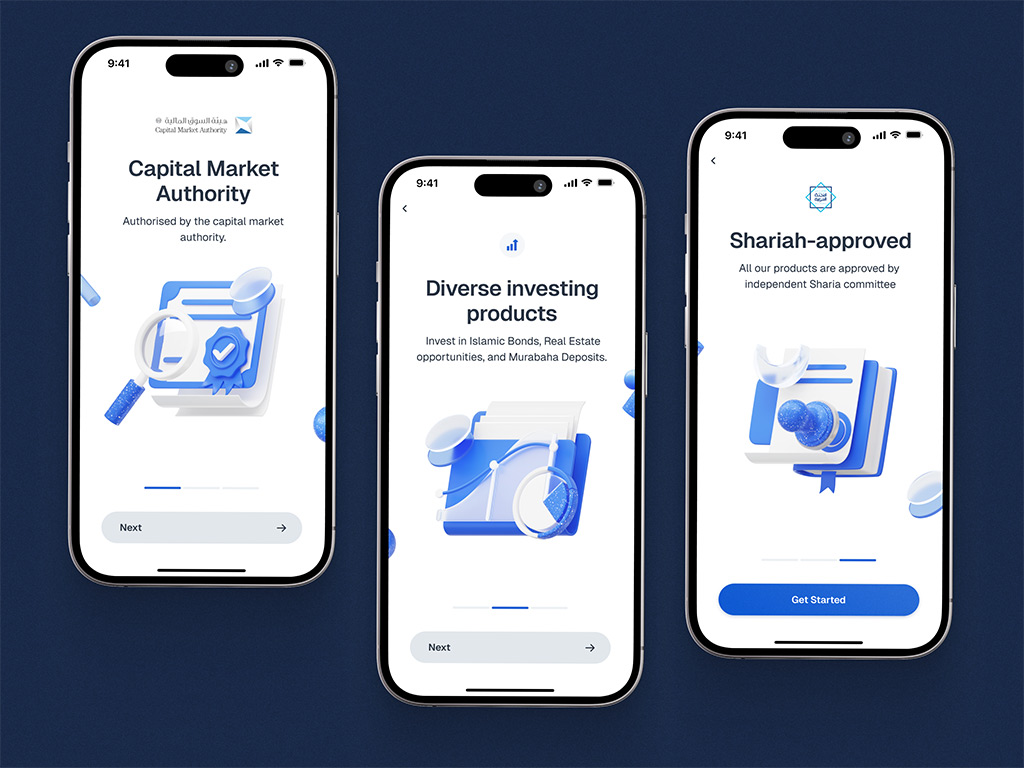

- Dinar Investment: Hi-Tech and Symbolic Illustrations

With Dinar Investment, we took a more abstract approach. Instead of using human figures, we designed hi-tech, symbolic visuals that incorporate Arabic religious symbols—such as a Shariah-compliance sign and references to the Quran. These elements reinforced the fintech app’s adherence to Islamic finance principles while maintaining a modern and professional tone. The blend of geometric patterns and futuristic motifs allowed us to communicate trust and technological sophistication without the need for literal human depictions.

Onboarding illustrations for Dinar app

Whether through symbolic designs or carefully crafted character illustrations, our goal is always to create visuals that build trust, enhance the user experience, and reinforce the app’s core values.

KYC & Risk Profiling: Tailoring the User Experience

Islamic principles, regional preferences, and cultural sensitivities deeply influence KYC and Risk profiling in Arabic Shariah-compliant fintech apps. The process is carefully designed to emphasize halal investments, ethical considerations, and a conservative approach to risk. It reflects the user values in the Middle East accounting for their financial goals, and provides a personalized financial experience. By tailoring risk profiling to include Shariah compliance, wealth preservation, and long-term growth, these apps help users make informed investment choices that align with their financial goals and religious beliefs.

Key considerations:

- Ensure KYC processes verify Shariah-compliant income sources.

- Tailor risk profiles to align with Islamic investment preferences, focusing on long-term wealth preservation.

- Provide flexibility for users to adjust their portfolios based on evolving financial needs.

Our solution:

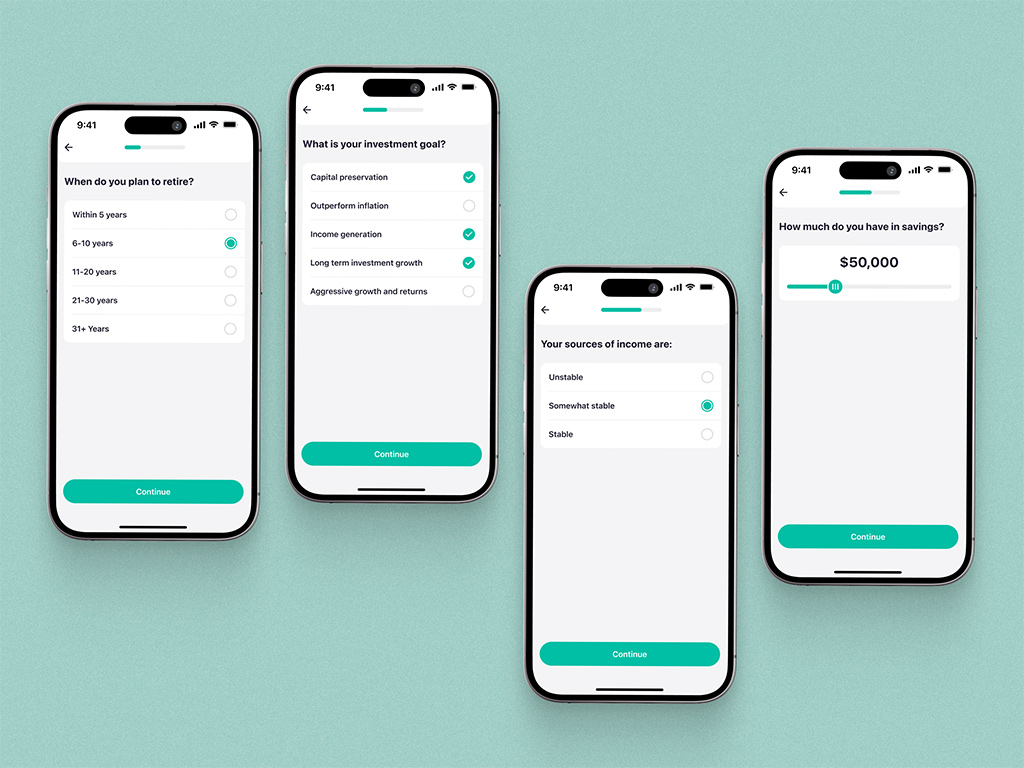

When we were designing the KYC flow for the ZAD app, we aimed to make the process both informative and user-friendly. The flow included a simple yet thorough questionnaire asking about key factors like the user’s investment goals, savings, income sources, and social status. This information was essential in tailoring the investment experience to each individual.

Questionnaire in ZAD app

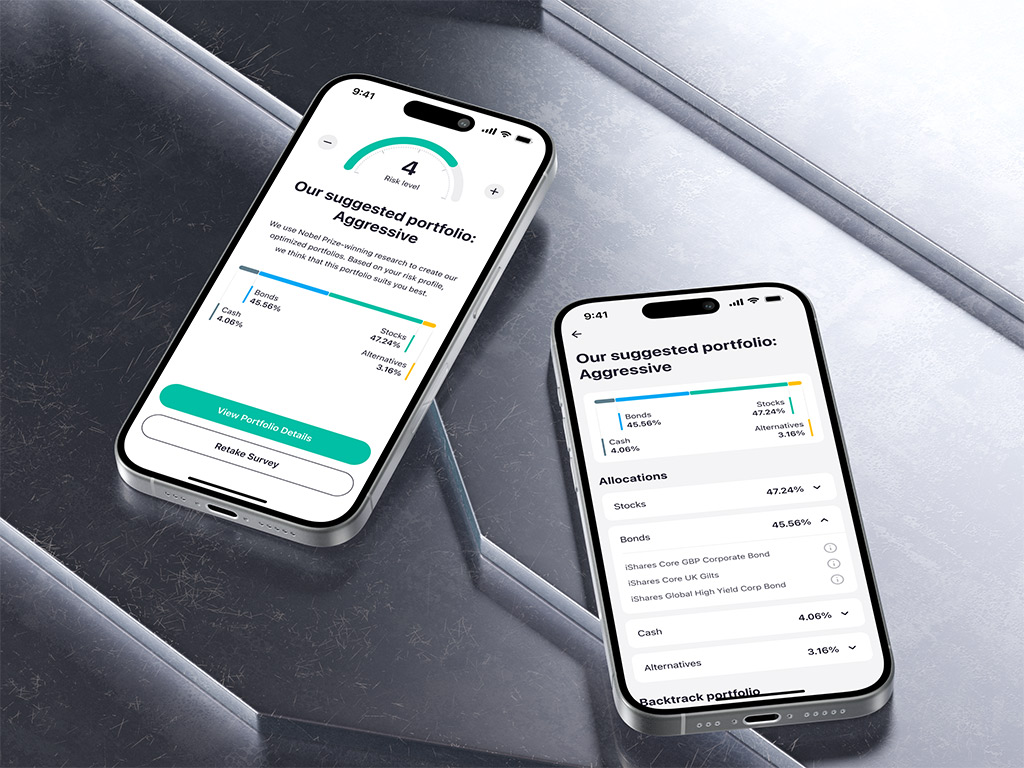

Once the questionnaire was completed, the user received a personalized portfolio suggestion aligned with their financial goals and risk tolerance. The backtrack portfolio feature made this process even more dynamic and allowed users to revisit and adjust their portfolios based on new preferences or changing circumstances. With this interactive approach, they stayed in control of their investments while receiving personalized, relevant advice.

Risk profiling in ZAD app

Conclusion

Fintech app development for the Middle East and Near East requires a nuanced approach incorporating Shariah compliance, local regulations, and cultural sensitivities. By blending these elements with modern technology and user-friendly design, we have developed successful fintech solutions for clients in the region.

Whether it’s ensuring religious compliance, building secure systems, or creating culturally resonant designs, our experience with projects like ZAD and Dinar Investment has allowed us to deliver apps that foster trust and engagement among users.

Have an idea for a fintech app and need a development team to implement it? Reach out to us and let’s work together on your future project.

* * *

Written by Mary Moore and Mary-Ann Sadovaya